Business

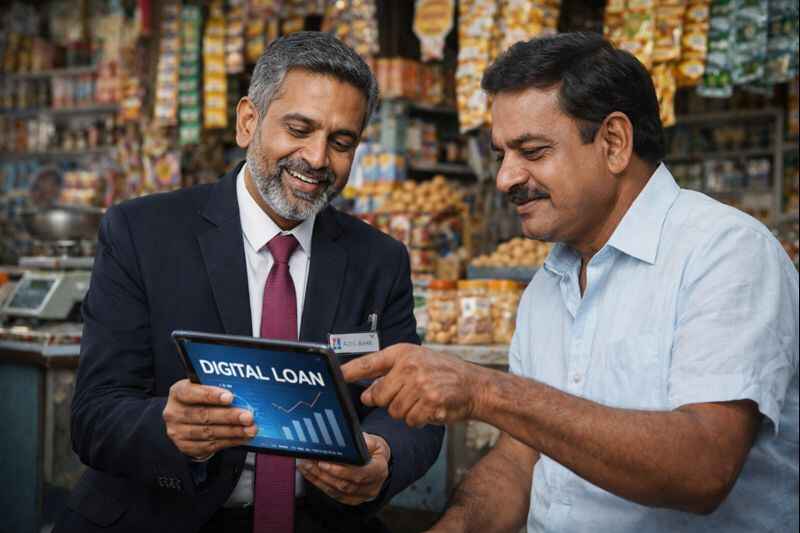

Axis Bank Rolls Out New Digital Loan Product to Support MSME Cash Flow

Axis Bank has introduced a new “Digital Merchant Cash Advance Loan” product aimed at providing fast, unsecured credit to small merchants and MSMEs, offering a big boost to businesses struggling with working capital needs. The initiative is designed to simplify credit access, reduce dependency on lengthy loan approvals, and help enterprises maintain smoother cash flow.

The loan product is fully digital, allowing eligible merchants to apply, receive approval, and access funds without traditional paperwork barriers. Instead of relying only on collateral or large financial records, the system evaluates business transaction data and digital payments activity, making it especially useful for small retailers, shop owners, service businesses, and independent traders.

Industry experts believe this move strengthens the fintech lending ecosystem by merging banking strength with technology-driven credit assessment. With many MSMEs facing cash constraints due to delayed payments, seasonal demand variations, and rising operational costs, faster liquidity access could support growth, inventory management, and business continuity.

Axis Bank’s launch also reflects a broader shift in India’s banking approach — moving toward digital innovation, inclusion, and empowering smaller enterprises that form the backbone of the nation’s economy.

For MSMEs seeking convenient, reliable financial support, this development may prove to be a significant step forward.

Business

India Aviation Growth 2026: Massive Boeing Orders Planned

India is prepared to place aircraft orders worth $70–80 billion with Boeing, Commerce and Industry Minister Piyush Goyal said, indicating a potential total outlay of nearly $100 billion when engines and spare parts are included.

Speaking to reporters on February 5, the minister said that confirmed and pipeline orders together are valued at approximately $70–80 billion. Factoring in engines, maintenance components and related equipment, the total figure could reach close to $100 billion.

Aviation Demand on the Rise

The remarks reflect India’s expanding aviation market, driven by rising passenger traffic and fleet expansion plans of domestic carriers. India is currently one of the fastest-growing aviation markets globally, with airlines aggressively placing long-term aircraft orders to meet demand.

Context: Boeing Litigation

The comments come at a time when Boeing is facing litigation related to last year’s Air India crash in Ahmedabad. Families of victims have filed lawsuits alleging technical defects contributed to the accident. The investigation remains under review, and no final determination has been made.

Broader US Trade Engagement

Goyal also highlighted the broader economic relationship with the United States, stating that India could potentially procure up to $500 billion worth of American goods over the next five years.

This follows recent trade developments between New Delhi and Washington. US President Donald Trump earlier announced that both countries had reached a trade understanding, including tariff adjustments. According to the announcement, US tariffs on Indian goods would be reduced to 18%, while India would lower duties on certain American imports under a phased arrangement.

A joint statement formalising the first phase of the agreement is expected soon. A broader agreement is anticipated by mid-March, after which the revised tariff structure would take effect.

Agriculture and Food Security Clarifications

Sources indicated that key agricultural staples such as rice, wheat, sugar, dairy and corn are excluded from the trade arrangement. Officials clarified that agricultural imports from the US would focus on products not produced at scale in India, addressing concerns related to food security and farmer interests.

Business

Manufacturing Strength Supports Early 2026 Economic Optimism

India’s manufacturing sector closed 2025 on a positive note, with December Purchasing Managers’ Index (PMI) data indicating a moderate expansion in factory activity. The latest figures suggest steady growth in output, new orders, and employment, reinforcing optimism about the sector’s performance in early 2026.

According to industry indicators, manufacturing output continued to rise as demand conditions improved across domestic and export markets. Firms reported better order inflows, supported by easing input cost pressures and relatively stable supply chains. The improvement points to resilience despite global economic uncertainties and tighter financial conditions in some international markets.

The PMI reading remaining above the expansion threshold reflects sustained momentum in industrial activity, particularly in consumer goods, intermediate products, and select capital goods segments. Manufacturers also indicated cautious optimism about future output, citing improved business confidence and expectations of stable demand.

Economists note that the manufacturing sector’s steady performance is significant for India’s broader economic outlook, as it supports employment generation, export growth, and overall GDP momentum. While challenges such as global demand volatility and geopolitical risks remain, the December data suggests that India’s factories are entering 2026 on a relatively strong footing.

Overall, the PMI numbers reinforce expectations that manufacturing will continue to play a key role in driving India’s economic growth in the coming months.

Business

Gold Continues Uptrend in India as Global Sentiment Turns Cautious

Gold prices in India edged higher today, driven by increasing global safe-haven demand and a softer U.S. dollar. Persistent geopolitical uncertainty, cautious investor sentiment, and expectations around global monetary policy are encouraging investors to move toward gold as a stable store of value.

Analysts say the decline in the U.S. dollar has supported bullion prices internationally, making gold cheaper for buyers holding other currencies and boosting overall demand. Alongside that, concerns over economic stability and market volatility have strengthened gold’s position as a preferred investment option.

In India, retail interest remains steady as consumers continue to view gold not only as a cultural asset but also as a long-term financial safeguard. Jewellery demand and investment-grade purchases are both witnessing positive traction, especially with the wedding and festive season contributing to sentiment.

Market observers believe that if global uncertainties persist and central banks maintain dovish signals, gold prices may continue to hold firm or even see further upside in the near term.

-

Entertainment2 months ago

Entertainment2 months agoDhurandhar Dominates Theatres: A Winning Streak Bollywood Can’t Ignore

-

Hyderabad2 months ago

Hyderabad2 months agoHYDRAA Recovers Public Land Worth ₹2,500 Crore from Encroachers in Major Crackdown

-

Hyderabad2 months ago

Hyderabad2 months agoTollywood Actor Varun Tej and Lavanya Tripathi Spotted With Newborn Son Vaayuv at Hyderabad Airport

-

Telangana2 months ago

Telangana2 months agoTelangana Govt Plans Major Boost to Rural Employment Scheme for 2026

-

Entertainment2 months ago

Entertainment2 months agoSehwag Praises Tollywood, Calls Mahesh Babu and Allu Arjun His Favourite Stars

-

Entertainment2 months ago

Entertainment2 months agoHistoric Collaboration: Chiranjeevi and Mohanlal Join Hands for Major Pan-India Project

-

Politics2 months ago

Politics2 months agoUnrest in Bangladesh Continues, But Leaders Credit India for Diplomatic Stability

-

Entertainment2 months ago

Entertainment2 months agoTollywood Buzz: Allu Arjun and Trivikram Reportedly Planning Massive Mythological Film